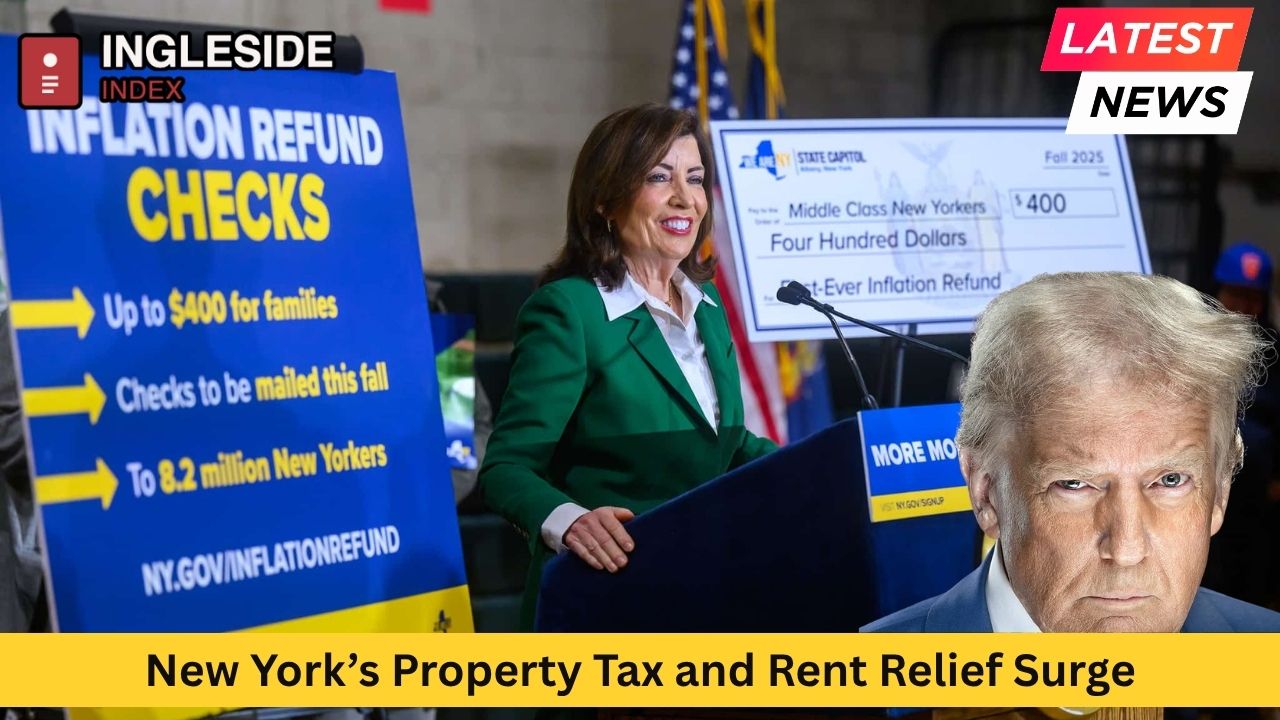

New York is rolling out one of its most ambitious rounds of property and rent‑related relief in decades. From soaring rents in New York City to heavy property tax burdens on homeowners upstate, the state’s new programs offer fresh hope. This article explores how seniors, low‑income families, and homeowners across cities such as New York City, Albany, Buffalo, Rochester, Syracuse, Yonkers, Long Island, the Hudson Valley, and the Finger Lakes region are benefiting from an unprecedented wave of targeted assistance.

Property Tax Relief through the STAR Program

The flagship initiative is the School Tax Relief (STAR) program, widely recognized across New York State for easing the burden of school district property taxes. This year, nearly three million residents are tapping into a massive relief wave totaling roughly $2.2 billion.

Basic STAR is aimed at homeowners with combined household incomes below $500,000 and exempts around $30,000 of property value. Enhanced STAR is tailored specifically for seniors aged 65 or older (with incomes below approximately $107,300 in 2025), offering higher exemptions or credit amounts up to $1,500 in some cases. These checks began arriving in June and will continue into early fall statewide, including in New York City, Western New York (e.g. Buffalo, Rochester), Mid‑Hudson Valley, Long Island, Central New York (e.g. Syracuse), and the Capital District. Most recipients receive between $350 and $600 via Basic STAR, while seniors often see amounts from $700 to $1,500 depending on income and residence location.

These disbursements mark an unprecedented scale of relief, with local regional breakdowns showing, for example, over $698 million directed to Long Island and more than $158 million within the five boroughs of New York City.

How the New STAR Phase is Different

What makes this year’s STAR rollout distinct is its timing and scale: the summer‑to‑fall schedule of credit checks ensures immediate cash in hand rather than only a reduction in mailed tax bills. Residents in urban hubs like NYC, Yonkers, Syracuse, Rochester and Buffalo may also benefit from credits toward city or municipal school taxes—not just county schools—amplifying impact. Returning recipients are typically auto‑enrolled, while new applicants or those whose income exceeded prior thresholds need to file via the state portal by the next window, opening mid‑September.

Senior‑Focused Exemptions Beyond STAR

Beyond STAR, New York offers multiple exemption programs that are especially valuable to seniors:

Senior Citizen Homeowners’ Exemption (SCHE)

Seniors aged 65 and above, with incomes up to roughly $58,399, may qualify for SCHE—a program that reduces the assessed value of their primary residence by 5 to 50 percent depending on income band. In cities like New York City and Albany, this can translate into substantial annual tax savings. Exemption must be reapplied for every two years.

Senior Citizen Rent Increase Exemption (SCRIE)

For eligible seniors (62 and older, income under ~$50,000) living in rent‑regulated apartments in New York City, SCRIE freezes their rent at the current level even if landlords raise it. Landlords receive a property tax credit covering the increase, and tenants continue paying the pre‑increase rent—providing housing stability amid rising market rents.

A 2025 state bill (S2451A) proposes capping eligible tenants’ rent payment responsibility to no more than one‑third of household income—ensuring affordability is preserved even as local authorities opt in regionally.

Disability Rent Increase Exemption (DRIE)

A similar freeze and credit model applies to renters with disabilities, subject to income and rent‑regulated status. Both SCRIE and DRIE ensure eligible individuals are shielded from steep rent hikes.

Real Property Tax Credit for Low‑Income Homeowners and Renters

For households with gross income under $18,000, the Real Property Tax Credit program offers refunds on paid property taxes or rent. New York City residents may also access an enhanced version providing up to $500 in credit for incomes below $200,000. These programs are particularly valuable for renters and homeowners in cities like Buffalo, Rochester, Albany and Syracuse.

Regional Impact by City and Area

New York City and Long Island

In the city, around 483,000 homeowners receive STAR relief totaling $158 million; Long Island sees over 580,000 recipients receiving nearly $700 million. SCHE and SCRIE are heavily utilized, given high living costs and rent levels (median rent approached $3,700/month in late 2024). Nearly two million tenant‑households live in rent‑stabilized units citywide.

Mid‑Hudson Valley and Capital District

Homeowners in Westchester, Dutchess, Orange, Albany and Troy benefit significantly—with over 400,000 recipients receiving more than $488 million in STAR relief. Regional officials highlight its role in helping seniors and working families manage high property tax burdens.

Western New York: Buffalo, Rochester and the Finger Lakes

Nearly 320,000 recipients in Western New York are due relief totaling $178 million; the Finger Lakes region accounts for nearly 279,000 recipients amounting to $205 million. These benefits boost affordability in cities where incomes often lag behind downstate standards.

Central and Southern Tier

In regions including Syracuse, Elmira, Binghamton and Ithaca, STAR relief reaches over 176,000 recipients in Central New York and about 156,000 in the Southern Tier, providing substantial support where property costs are tight relative to income.

The Broader Financial Context: 2025 State Budget and Housing Support

The state’s 2025 budget, valued at $254 billion, allocates substantial funds toward affordability, including property tax relief, expanded Medicaid, child tax credits, and a new housing voucher program targeting more than 2,500 at‑risk residents with $50 million backing. Critics warn of federal funding uncertainty, but supporters see these initiatives as critical anchors for seniors and struggling families.

Why This Relief Matters for Seniors and Low‑Income Families

Affordable Stability for Seniors

Many seniors live on fixed incomes, especially in urban and suburban regions. Enhanced STAR checks up to $1,500, combined with SCHE and SCRIE protections, significantly reduce housing cost burdens. For instance, those in New York City or Albany on incomes under $58,000 could see their property assessments cut by half and rent hikes frozen—keeping more in monthly budgets.

Family Budgets Across Income Levels

Middle‑income working families benefit from Basic STAR and real property tax credits, helping bridge increasingly tight margins. For example, households earning under $500,000 statewide may receive credits of $350–600, easing tax pressure in expensive areas like Long Island and mid‑Hudson counties.

Ripple Effects in Local Communities

With recipients spending more locally on groceries, health care, energy and daily expenses, the flow of relief into neighborhoods strengthens local economies. These funds particularly support areas with high cost burdens and declining population growth.

How to Apply or Keep Benefits Rolling

Eligible homeowners previously enrolled usually continue receiving STAR benefits automatically. New homeowners or households near income thresholds must apply online by mid‑September when the next application window opens.

Senior homeowner exemptions require biennial renewal. SCRIE and DRIE applications are processed through NYC’s housing or tax authorities, with income documentation required. As local governments begin adopting the proposed cap rent‑at‑one‑third proposal, families should check local statutes to confirm their status.

Challenges and Ongoing Debates

Some critics argue that expansion of these programs—particularly shifting costs to state funds or higher‑income taxpayers—could strain resources if federal aid dwindles. Proposed legislation like the “Big, Beautiful Bill” in Congress would adjust federal SALT deduction caps and protect middle‑income earners, but uncertainty remains.

Additionally, rent freeze proposals for rent‑stabilized tenants (such as the mayoral candidate’s plan in NYC) spark debates over long‑term impacts on housing maintenance and new construction, especially in cities where vacancy rates hover near historic lows.

Conclusion: A Historic Infusion of Relief

New York’s summer entering fall of tax‑credit and property‑exemption programs represent one of the largest relief efforts in the state’s recent history. From New York City tenements to the suburbs of Long Island and inland cities across the Finger Lakes, Southern and Central New York, nearly three million households see meaningful financial support.

The combined effect of STAR checks, exemption programs like SCHE and SCRIE, and rent protections crafts a powerful policy mosaic. For tens of thousands of seniors and low‑income families, it’s not just a check—it’s stability, dignity, and peace of mind.

Sources:

Leave a Reply