As the economic pressures of 2025 continue to impact many households across the United States, the federal government is rolling out a new stimulus initiative designed to provide critical financial relief to low-income Americans. With rising costs in everyday essentials such as groceries, housing, and utilities, millions of families and individuals are set to receive direct payments aimed at helping them navigate these challenging financial times.

What Is the 2025 Federal Stimulus?

The centerpiece of this federal aid is a one-time stimulus check of approximately $1,390 issued directly to eligible recipients. This payment is designed to serve as a financial lifeline, easing the strain of inflation and high living costs on low- and middle-income households. The stimulus effort builds on previous economic relief measures but is tailored to meet the unique conditions of 2025.

Who Is Eligible for the Stimulus Payment?

Eligibility for this 2025 stimulus payment primarily depends on income level, tax status, and participation in certain federal benefit programs. Those most likely to qualify include:

-

Individuals filing taxes as single with incomes up to $75,000.

-

Married couples filing jointly with incomes up to $150,000.

-

Heads of household with incomes up to $112,500.

-

Recipients of Social Security benefits including SSDI (Social Security Disability Insurance), SSI (Supplemental Security Income), and those receiving VA (Veterans Affairs) benefits.

-

Families with qualifying dependents may receive additional amounts on top of the base payment.

Importantly, this payment is tax-free and will not affect other government benefits such as Medicaid, SNAP, or housing assistance programs.

How and When Will Payments Be Delivered?

The IRS will distribute the stimulus payments through various methods including direct deposit, paper checks, and Economic Impact Payment (EIP) debit cards. Those who have recently filed federal tax returns or receive federal benefits will likely receive their payments automatically. Non-filers or new beneficiaries may need to apply or register via an updated IRS portal.

Payments are expected to be rolled out starting mid-2025, with many recipients seeing the funds during the summer months. Early tax filers and those with up-to-date direct deposit information should receive their payments the fastest.

What Can This Stimulus Do for Recipients?

While the size of the stimulus check may not cover all expenses, it provides significant help in managing essential household costs. Experts encourage recipients to consider using the funds for:

-

Rent or mortgage payments

-

Utility bills such as electricity, gas, and water

-

Groceries and medical supplies

-

Childcare and education expenses

This injection of cash can help reduce financial stress and prevent debt accumulation, especially credit card debt or overdue bills.

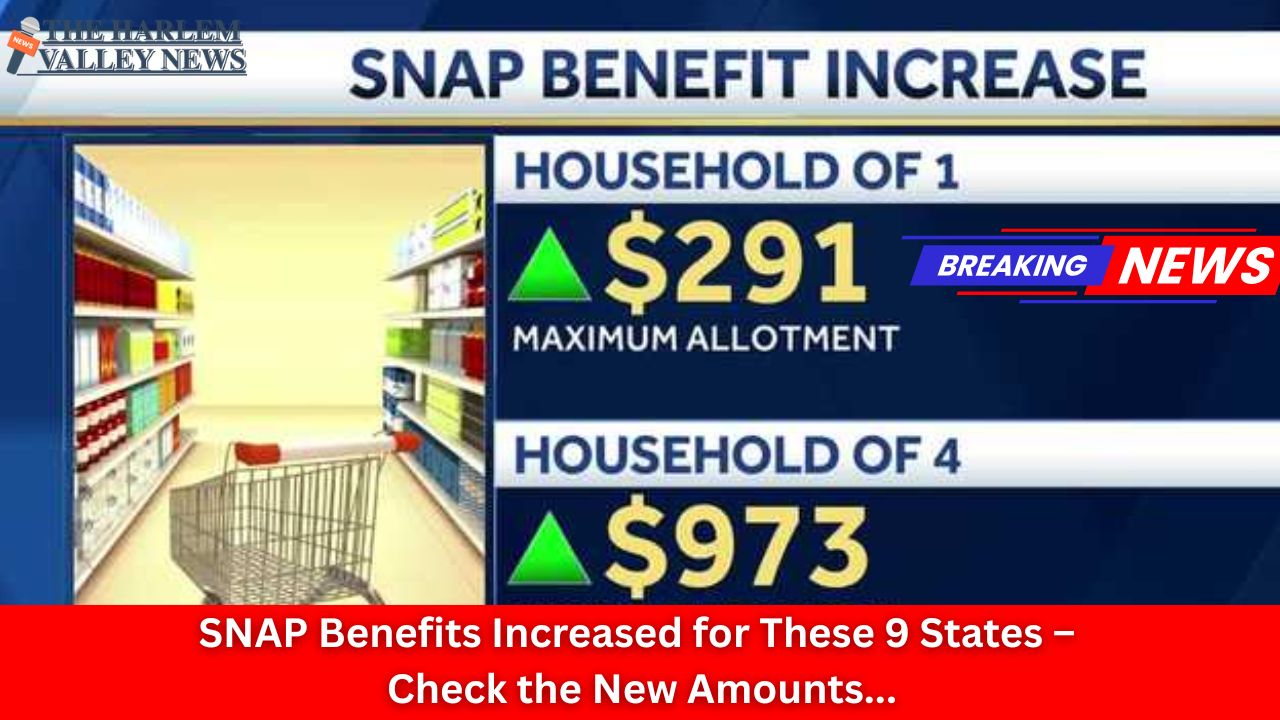

Additional State-Level Payments

Alongside the federal stimulus, several states are implementing their own relief measures. For instance, programs in California offer additional family assistance, while Alaska continues its Permanent Fund Dividend payments, providing eligible residents with unique economic support.

Looking Forward

The federal stimulus for 2025 reflects ongoing efforts by lawmakers and agencies to support vulnerable Americans amidst economic uncertainty. While the current initiative is a one-time payment, officials remain vigilant in monitoring inflation, employment, and consumer needs, leaving open the possibility of future relief actions if required.

For those eligible, it is crucial to verify personal information with the IRS and stay informed about payment schedules to ensure timely receipt of this crucial aid. As each dollar counts, this federal stimulus aims to help millions of Americans maintain stability and meet their basic needs in 2025.

Leave a Reply