California’s love affair with pets is stronger than ever, with more households than ever before welcoming furry companions. Yet despite the steady rise in the state’s pet population—particularly among dogs—Californians are spending less on their pets, especially when it comes to veterinary care.

Preliminary data from the 2024 AVMA Pet Ownership and Demographic Sourcebook, presented at the American Veterinary Medical Association’s annual Veterinary Economic and Business Forum, reveals a fascinating paradox in the Golden State: more pets, but tighter budgets. The forum, held virtually in October 2024, offered early insights into national and state-level pet trends based on survey data collected throughout 2023 and early 2024.

Pet Populations in California Mirror National Growth Trends

Like much of the country, California has seen a sharp rise in dog ownership, reaching historic highs in 2024. The dog population rebounded after a brief dip in 2023, surpassing its previous peak and contributing to a nationwide total of 89.7 million dogs—a leap from just 52.9 million in 1996.

In contrast, cat ownership has seen slower, more gradual growth, rising from 59.8 million in 1996 to 73.8 million in 2024. Though California remains a stronghold for both cat and dog lovers, the rate of dog adoptions and acquisitions far outpaces that of cats, signaling a broader shift in preference or lifestyle suitability.

The number of households in California owning dogs has grown significantly over the last two decades. In 1996, about 31.6% of U.S. households owned dogs. That figure now stands at 45.5%, with cat-owning households also increasing from 27.3% to 32.1% in the same period. With California being one of the most populous states, these trends are particularly visible in urban centers like Los Angeles, San Diego, and the Bay Area, where pet-friendly housing and services are more accessible.

Spending Drops Despite Growing Pet Ownership

While pet ownership is on the rise, spending per pet is trending in the opposite direction.

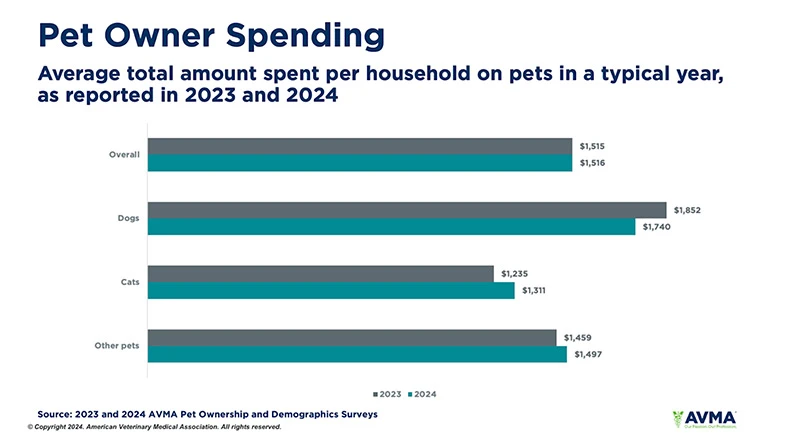

In 2024, the average amount spent per pet-owning household in California (excluding adoption or purchase costs) remained flat year over year at roughly $1,515. However, a closer look reveals that dog owners actually cut back on spending, while cat owners spent slightly more than they did in 2023.

This decline in spending is most noticeable in veterinary care, which typically accounts for about one-third of all pet expenses. The average cost of veterinary care per household dropped by 4%, from $190 in 2023 to $147 in 2024. For dog owners specifically, that translated to a 7% decrease in veterinary care spending, down to $580. Cat owners, on the other hand, spent $433 on average—6% more than the previous year.

Dog veterinary visits also decreased in cost, from an average of $265 in 2023 to $214 in 2024, while cat visit costs fell from $163 to $138. The decline may reflect increased price sensitivity, limited access to care, or a growing number of pet owners opting for fewer checkups.

Pet Owners Still Prioritize Companionship Over Costs

Despite reduced spending, Californians’ emotional investment in their pets remains strong. More than 88% of dog owners and 84% of cat owners in the state say they consider their pets members of the family. Routine checkups and preventive care continue to be the most common reasons for veterinary visits, cited by around 80% of pet owners.

However, a troubling trend has emerged: a growing number of Californians are skipping vet visits altogether. In 2024, 22.8% of dog owners and 31.1% of cat owners said they didn’t seek veterinary care because they believed their pet didn’t need it. That’s a significant increase from 12.3% and 17.4%, respectively, in 2023.

This shift may be tied to cost concerns. Only 28.2% of pet owners expressed high satisfaction with the cost of veterinary services, despite reporting high satisfaction with veterinarians and clinic staff.

Income Gap Reflected in Pet Spending

Demographic patterns in California echo national findings: dog ownership is more common among higher-income households, while cat ownership skews lower-income. The most common income range for dog-owning households was $50,000–$74,999, while cat owners most frequently fell into the $30,000 or less bracket.

This income disparity appears to impact not just how much is spent on pets, but also how frequently owners seek care. While 86.8% of dog owners said they had a regular vet, only 74.2% actually visited one in the last year. Among cat owners, 77.1% had a regular vet, but just 57.3% made a visit in 2024.

Looking Ahead: More Pets, Smarter Spending

As California’s pet population continues to expand, veterinary professionals are being urged to rethink how they engage with pet owners. Maisey Kent, who presented the AVMA findings, emphasized the need for clinics to enhance the client experience—especially the checkout process—and track key satisfaction metrics more effectively.

“Veterinary care remains a critical part of pet ownership, but as economic pressures mount, practices must adapt to ensure pet owners feel both valued and supported,” Kent noted.

While the emotional bonds between Californians and their pets grow stronger, the financial realities of inflation, housing costs, and economic uncertainty appear to be reshaping how pet care is prioritized. Whether these shifts are temporary or part of a lasting transformation in pet economics remains to be seen.

About the Report

The 2024 AVMA Pet Ownership and Demographic Sourcebook is now available. It is free for AVMA members and costs $375 for non-members. The comprehensive report includes in-depth data on U.S. pet ownership trends, veterinary care usage, spending behaviors, and pet-owner demographics—valuable insight for industry professionals, veterinary clinics, policymakers, and pet service providers across California and beyond.

Leave a Reply