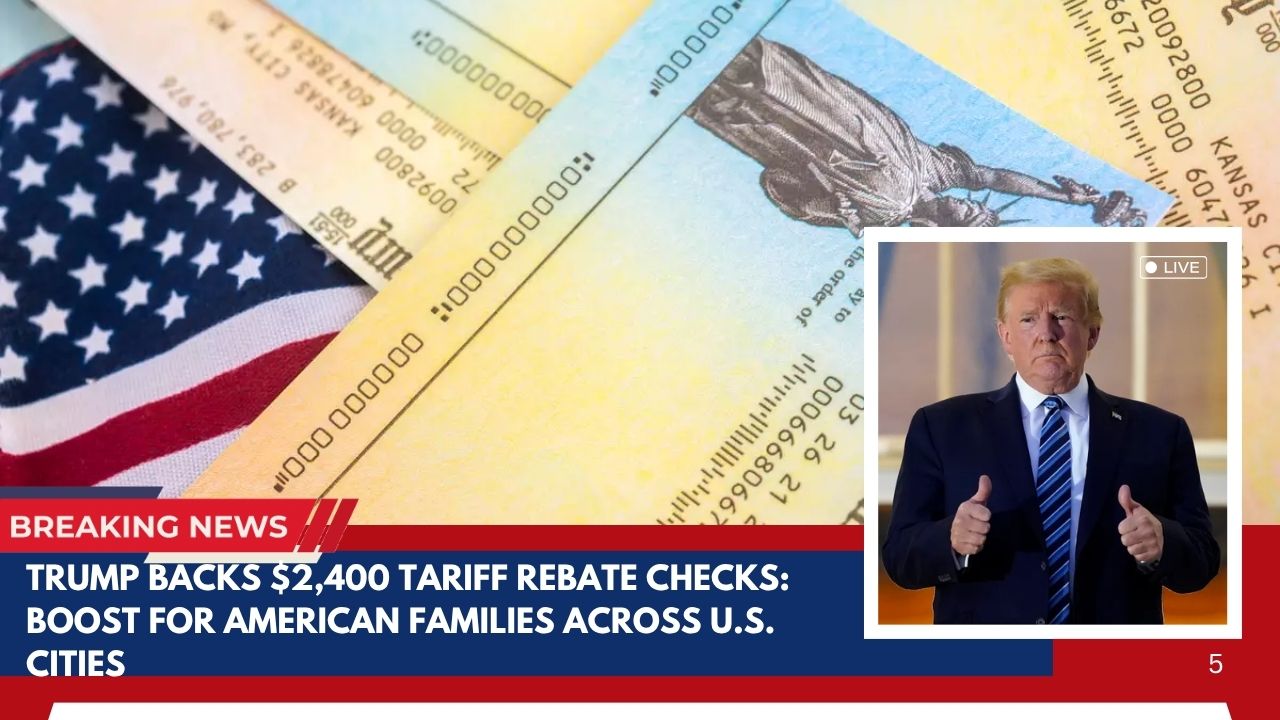

Washington, D.C: A fresh economic relief proposal is stirring debate in Washington: Senate Republicans are championing a bill that would send $600 checks to most Americans, funded entirely by the billions collected from recent tariffs. This move, introduced by Senator Josh Hawley (R-Mo.), seeks to return tariff-generated revenue directly to families—much like the popular stimulus checks during the COVID-19 pandemic. Here’s what you need to know.

Why $600 Checks – and Why Now?

Background

In recent years, tariffs imposed on imported goods have delivered a windfall to the federal government, with the Treasury reporting a record $27 billion collected in just June 2025, amounting to over $150 billion year-to-date. With tariff revenues reaching historic highs, Sen. Hawley argues it’s time for American families to share in the wealth, especially after enduring turbulent economic times.

The Aim

-

Offset Cost of Tariffs: Tariffs often lead to higher prices for everyday goods. The $600 check is designed as a rebate to help Americans cope with these hidden costs.

-

Stimulate Household Budgets: The proposal mirrors earlier stimulus efforts, using government revenue to boost consumer spending and ease financial strain for lower- and middle-income families.

Key Details of the Proposal

| Feature | Details |

|---|---|

| Payment Amount | $600 per adult and child |

| Example Family of 4 | $2,400 total |

| Eligibility Thresholds | Full amount for individuals earning < $75,000; joint filers < $150,000 |

| Phase-Out | Payments decrease by 5% for higher earners |

| Potential for Increase | Checks could be larger if tariff revenue exceeds estimates |

| Funding Source | Exclusively from federal tariff collections |

| Current Status | Proposal introduced, awaiting Congressional action |

| Expected Timeline | No formal vote expected until after September, as Congress is recessed |

How Would It Work?

-

Automatic Deposits: Qualified Americans would see the rebate deposited just like previous stimulus payments.

-

Means-Testing: Not everyone gets the full amount. If your income is above the threshold ($75,000 for individuals; $150,000 for couples), your check will be reduced.

-

No Application Needed: The process would use IRS tax filings to determine eligibility and payment size.

-

Room to Grow: If tariff revenue continues rising, the rebate check size may also increase.

What’s Behind the Push?

Senator Hawley and GOP backers highlight the ongoing economic pressure on working families—from rising prices on everything from groceries to electronics, to the lingering impact of inflation. They argue that since American families bear the brunt of tariff-induced price hikes, they deserve some of the windfall now flooding federal coffers.

Quoting the movement’s rallying cry:

“Hard-working Americans should benefit from the wealth that Trump’s tariffs are returning to this country.”

While the bill has energized discussions, its supporters emphasize that a rebate would help counteract some of the higher costs Americans have shouldered due to these trade policies.

The Debate: Support and Skepticism

Supporters Say:

-

This is a rebate, not new government spending—it’s Americans’ money coming back to them.

-

It offers direct relief at a time of stubborn inflation and wage stagnation.

Critics Warn:

-

Some GOP senators argue it’s better to use the money for deficit reduction, given the $37 trillion national debt.

-

Economic analysts caution that distributing another round of checks—even if funded by tariffs—could fan inflation further.

How Does This Compare to Previous Stimulus Checks?

| Stimulus Era | Payment per Adult | Payment per Child | Income Cutoffs (Single/Joint) |

|---|---|---|---|

| CARES Act (2020) | $1,200 | $500 | $75,000 / $150,000 |

| 2021 “Round 2” | $600 | $600 | $75,000 / $150,000 |

| Tariff Rebate 2025 | $600 | $600 | $75,000 / $150,000 |

What’s Next?

With the bill newly introduced and Congress on summer recess, the timeline for action remains uncertain. The idea embodies a populist push to directly share government revenue from tariffs with citizens, but faces fiscal and political scrutiny within both parties.

Whether or not it passes, the $600 check proposal marks another chapter in the ongoing debate over who wins and loses from tariff policy—and how best to turn government income into economic relief for ordinary Americans.

Source:- https://www.foxbusiness.com/fox-news-politics/senate-republicans-wants-americans-get-600-checks-from-tariff-revenue

Leave a Reply